Marine insurers and classification societies serve and support the marine shipping industry, in connected yet different ways, in approaching the problems of potential risk of ships operating in the Arctic. They have different roles and proceed in different vectors, but with their paths crossing at several points.

Published 18 October 2017

Particularly for Gard, being based in Norway, the problems of cold weather shipping have always been a core interest of the organization. From its earliest days, it insured ships embarking on whaling expeditions in the polar regions, and up to contemporary times, supporting vessels in oil & gas exploration in the Arctic.

However, when compared to global seaborne commercial traffic, the Arctic trade is a tiny fraction of same. Thus, insurance is provided at a relatively low cost for the volume of the activities underwritten, particularly in view of the high potential risks and claims from Arctic operations.

The conference theme contains a key word, “sustainable”, which so happens to overlap with a central tenet of Gard, as a marine insurer. Voyages and operations at sea are inherently risky – the moving vagaries of the sea itself and associated inclement weather, the remoteness of ships from land and population centers, the failure of equipment and the errors of personnel – all mean the possibility of accident and catastrophe is always present. Such causative factors are magnified in the Arctic, where the conditions are even harsher, the isolation at its most acute, and the special odds of accident increased, due to the presence of ice in various forms.

Sustainability

To be ‘sustainable’ as an insurer over time, the underwriters rating risks must be prudent in assessing and deliberating about all of the known factors that can lead to a marine casualty, trying to account for the unknown or unarticulated risks, and then properly calculate a premium payment to amortize properly that risk across the entire pool of assureds.

This task is succinctly described in Gard’s stated core purpose: to help our Members and clients in the marine industries to manage risk and its consequences.

At Gard, we take a broader view of ‘sustainability’, including external factors such as the environment, people and human rights, and an ethical stance to our business, as set forth below:

P&I and the marine insurance industry

Integrating sustainability in business through prevention and casualty handling

Developing products and services based on

International conventions

Requirements from society

Members and clients’ needs

For Gard, and most other insurers offering liability insurance for marine casualties (known in the shipping industry as ‘protection and indemnity insurance’ or, more simply, ‘P&I’), the responsibility to its assureds is even more profound. This is because it is a ‘mutual’ insurer in organizational set-up, meaning that the company is actually entirely owned by the assureds themselves (this is why they are called ‘Members’, and also why mutual P&I insurers are known colloquially as ‘clubs’).

Thus, all of the ‘Members’ enrolled in a ‘P&I Club’ like Gard, share collectively in the risks taken on by Gard, so in benign years, premiums are kept low and in years of many accidents, more premium is billed to the Members. This mutuality has the practical effect of the ‘Club’ and its members acting to self-police to ensure that ships and ship owners are operating at the highest levels of prudence and safety, to avoid accidents if possible. Such accident avoidance translates into lower claims numbers for any given year, and this positively effects the insurance costs borne by the members for that period-the collective financial interest acts as a powerful impetus.

This character of mutuality of P&I Clubs is the prime influence of moulding these organizations into entities offering a high level of specialized service to its membership, at the lowest possible cost. But unlike regular insurance companies, P&I Clubs do not make ‘profits’ per se, but instead aim to only take in revenues slightly more than the cost of claims + organizational overhead. Money in excess, either reaped through investment gains of the received premium revenue and/or surplus due to lower than predicted claims costs, are then set aside in an account as ‘free reserves’. Such reserve funds can be drawn upon in the future in the case of large unanticipated claims, thus buffering the impact of such unpredicted events, allowing for long-term financial stability. In addition, P&I Clubs also purchase reinsurance policies to offer outside insurance payments to them for the occasional very large claims, that would otherwise fully consume the reserve amounts and cause fiscal instability in the mutual financial arrangement.

Therefore, loss prevention is a key element to the operation of a P&I insurer, since it can lead to significant overall cost reduction for the Members, who face unceasing commercial and financial pressures in a competitive business. This activity translates into assisting members with best practices and procedures, to be efficient, safe, and cost effective – 3 things which can, and should, coexist.

This manifests itself in a high level of service and interaction between the Club and an assured Member, much more so than is found present in shore based commercial insurance relationships.

It should be noted here that P&I insurance covers the legal liabilities that might come about, regarding injuries made to third parties or the environment. Any damage to the ship’s own structure or equipment, as a result of a marine accident, would be covered by the insurer providing Hull & Machinery (‘H&M’) insurance, which is usually procured on a fixed premium, term basis from a different insurer. In the case of a casualty, H&M insurance usually cooperates with P&I, working together on addressing the issues of the vessel involved in the accident (sometime the H&M insurance is also provided by the P&I insurer; Gard does this quite frequently). It is important to understand that in most situations involving a vessel in distress, it is the H&M insurance that handles the salvage arrangements, to act to to return the ship to a normal operating status/location.

How is marine insurance contributing to sustainability, in Arctic trade and elsewhere?

Answer: By reducing the footprint of global trade

In reducing the overall ‘footprint’ of global marine shipping, ‘sustainability’ is made possible in various ways by the activity of P&I Clubs:

For their members: reducing their costs, preventing the need for duplicative operational regulations that can increase operating expenses; allowing them to be permitted to operate in all of the oceans, lakes, and rivers of the world, because they are viewed as responsible actors with low impact to the environment;

For the marine insurer itself: by keeping accident rates low and thus allowing for more predictable risks and premium demands; by being seen by governmental and non-governmental organizations as entities that assist in the protection of the marine environment; by preserving reserved capital so that it can be designated and used to cover increasing or new marine trades and activities;

For governments and general society: generating a positive view of marine shipping as an industry, allowing for inexpensive distribution of goods worldwide and fostering prosperous trade patterns in a world economy, demonstrating that the shipping industry can be a steward of the seas, rather than only seen as solely an exploiter.

Marine insurance and society

Integrating sustainability in cooperation with members and society

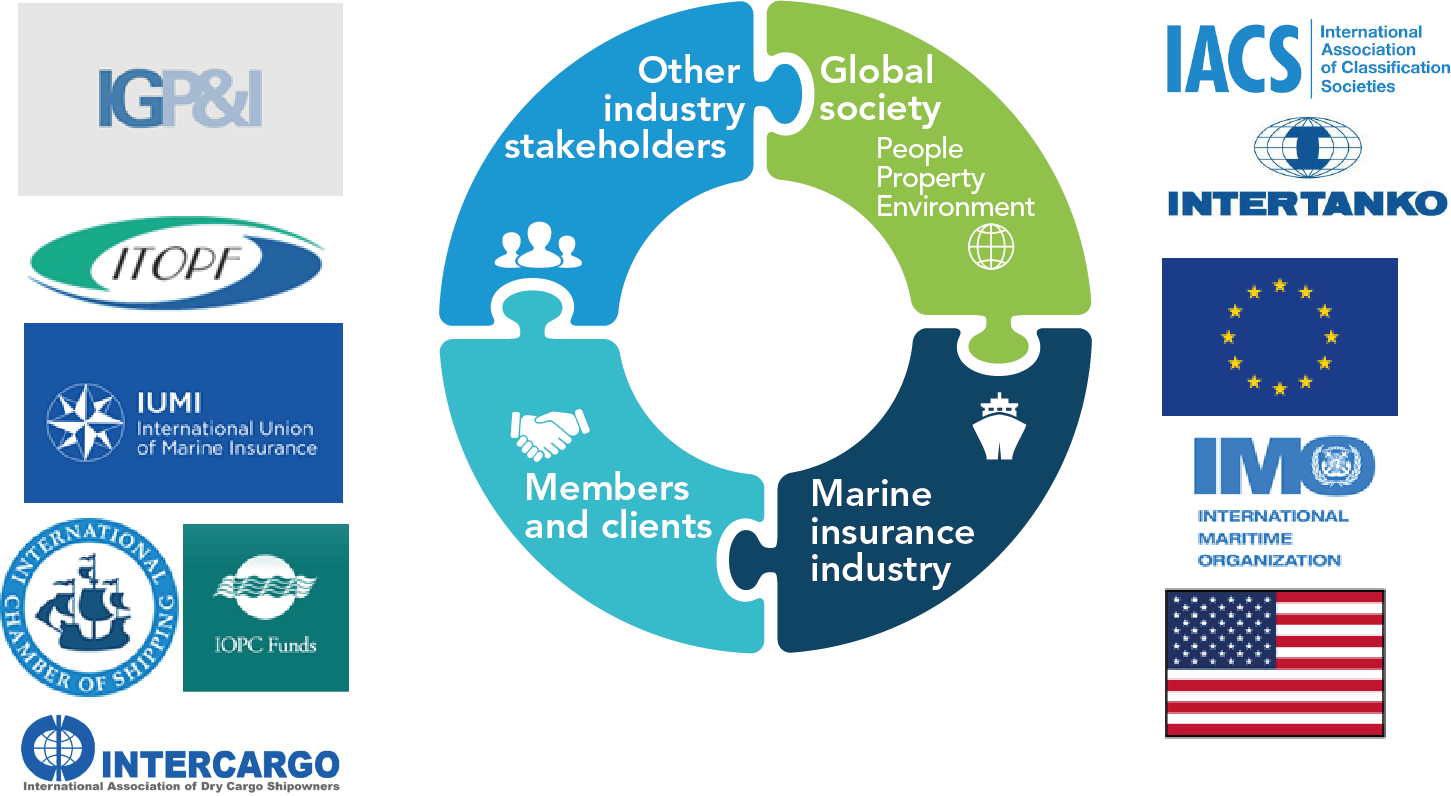

The foregoing diagram illustrates the relationship between the marine insurance industry and the world outside that industry-the other organizations, both governmental and non-governmental, which enhance the mission of the P&I Clubs, furthering their collective reach.

It should be noted that one of the organizations listed in the diagram is the International Association of Classification Societies (‘IACS’), a key partner of longstanding with P&I Clubs, and deserving of separate attention and discussion. Almost all ships entered with Gard are likewise entered with a classification society that is a member of IACS.

Classification societies

Classification societies came into being as the marine insurance industry became a uniform activity in the mid-1700’s. Underwriters insuring vessels needed a source of reliable information and assessment as to the level of seaworthiness of the ships they were insuring. In 1760, the first classification society was established (still existing today, and called Lloyd’s Register), which rated the shipping fleet in England as to the condition of each vessel, designating the level of fitness with letter/number designator labels, easily understood by the insurance community, and relied upon to answer the key question for the marine underwriter – how risky is a particular ship?

Sooner thereafter, classification societies sprung up in many places around the world, including France, Norway, Germany, Italy, Japan, and the United States. Today there are over 100 classification societies existing, but with the larger, more well-known organizations being members of IACS.

The classification societies are not guarantors of the safety of a ship or how it is operated. Instead, it examines and certifies, through a set of ‘Rules’, that the design, construction, and materials used/equipment of a particular ship meets the technical standards of strength and integrity at the time of inspection. This objective and independent evaluation is relied upon not only by marine insurance underwriters, but also governments, financial institutions, shipbuilders, repair yards, and other entities, as credible evidence of a soundly planned and built vessel. Many governments utilize the ship inspection reports of classification societies as the reports of ‘Recognized Organizations’, lending quasi-governmental effects to the work of the classification societies, since many governments lack the technical nautical knowledge possessed by the classification societies.

Classification societies are not ‘pure mutuals’ like P&I Clubs, but have dual aspects, carrying out both non-profit inspections and Rules related activities, and then also offering for-profit analysis and design services to ship-owners. This means that they are more ‘commercially minded’ organizations, although it must be said that societies within the IACS take measures to separate, and have as independent, the non-profit ‘Rules’ related services and the for-profit businesses that they also have established.

To have such a system of self-regulation of the shipping industry by such entities, classification societies must be wholly independent of ship owners, and be unbiased and uninfluenced in their technical assessments and decisions about ships and their condition.

As they are viewed as ‘Responsible Organizations’ by many national governments, this shows that classification societies have for the most part succeeded in occupying a unique role and position in the shipping world, as a respected, credible source of technical advice and judgement in nautical practices and procedures. Classification societies are also forward looking, developing standards for new ship designs and construction methods, and new types of ships for new types of trade.

In particular as to Arctic operations, classification societies have had a long involvement in setting design and material standards to apply to ships wishing to operate in the Arctic, particularly as to the special hazard of making contact with seaborne pack ice and fast ice, that is adjacent/attached to land.

The operations of ships in Arctic regions necessitate: a strengthening of the ship’s hull and associated framework structure, the installation of protective devices for the rudder and propeller, a more robust design, the heating of fluids and fuels, and other specialized measures.

Classification societies began to assess vessels and develop standards, using the experiences of ships in ‘first year ice’ in the Baltic Sea area. Simply put, ‘first year ice’ is that ice which annually forms and then disappears on the sea in an area. By contrast, ‘multiyear ice’ in the Arctic region is that ice which forms and does not annually disappear and builds over years – much harder and usually thicker than ‘first year ice’.

With regard to the Arctic, the classification societies have developed ‘Polar Class’ design and construction standards, which are to harmonize with the operational standards for such areas developed by the International Maritime Organization, a U.N. sponsored international body relating to maritime ship operations and policy. However, individual classification societies, somewhat confusingly, developed their own individual classification regimes and protocols for rating ships for Arctic service.

These confusing set of varying standards was finally harmonized by the International Association of Classification Societies in 2007, when it issued the first set of guidelines, the IACS Unified Requirements for Polar Class Ships.

The Polar Class levels are as follows:

PC 1 Year-round operation in all ice-covered waters

PC 2 Year-round operation in moderate multi-year ice conditions

PC 3 Year-round operation in second-year ice, which may include multi-year ice inclusions

PC 4 Year-round operation in thick first-year ice, which may include old ice inclusions

PC 5 Year-round operation in medium first-year ice, which may include old ice inclusions

PC 6 Summer/autumn operation in medium first-year ice, which may include old ice inclusions

PC 7 Summer/autumn operation in thin first-year ice, which may include old ice inclusions

Note: Ice descriptions follow the WMO Sea-ice nomenclature. http://www.jcomm-services.org/

Such classes primarily rank vessels on whether they can operate in the presence of first year ice and/or multi-year ice, and can do so with or without being accompanied by an escorting icebreaker, and the maximum thickness of the ice. Ships that are strong enough in power and construction, so that they can operated freely in any icy waters, can be assigned the additional label of ‘icebreaker’.

The combination of ice-classification of ships by classification societies and the practices and procedures set forth by the IMO in its ‘Guidelines for Ships Operating in Polar Waters’, establish a manner of operating ships that is safer and sounder environmentally, but it certainly does not eliminate entirely the risk that arises from navigating in that area of the world. Such dangers are still present.

There Is always risk – accidents can happen

By following sound procedures, even vessels not especially ice-classed have operated safely in Arctic waters. For example, in 2016, the cruise ship ‘Crystal Serenity’ (Finnish Ice Class 1C), made a 32 day voyage from Seward, Alaska to New York City, using the Northwest Passage route around Alaska and across the northern region of Canada. It was accompanied by escort icebreaker, and was fitted with special ice detection equipment. There was a reprise of the voyage in 2017, arriving in New York on September 16th, after 32 days of sailing, on schedule and fortunately without incident.

The KULLUK as seen grounded on Sitkalidak Island, Alaska, in January, 2013.

On the other hand, the underestimation of the incessant risk posed by the harsh conditions of the Arctic regions may constitute a case of too much risk unintentionally assumed by a vessel operator. Sudden changes in weather and sea conditions, coupled with lack of redundancy in case of equipment failure, can result in serious consequences. There is little margin for error, even with the best of planning.

One example of that would be the grounding of the drilling vessel ‘Kulluk’ on the Alaskan coast in January 2013, on Sitkalidak Island, Alaska, a remote area of the Aleutian Island chain. The official U.S. Coast Guard investigation of the incident indicated that a chain of errors, including the misapprehension of possible storm effects, some errors in planning, the lack of redundancy, and equipment failures, then led to the casualty – which fortunately did not result in any significant injury or damage, and no pollution occurred. Interestingly, the incident occurred not at the time of perceived high risk in the operation zone in the Chukchi Sea, but instead much further south, demonstrating that the zone of higher Arctic risks extends over a wider, larger operational area, not confined to within the Arctic Circle.

The Polar Code – A Way Forward

In January, 2017, the Polar Code went into effect. Created by the U.N. International Maritime Organization, the Polar Code applies to all commercial shipping in the Arctic and Antarctic regions. This Code, incorporating the IACS Polar Class rules mentioned above, creates a detailed set of regulations regarding structural and machinery requirements, high latitude navigation, and special or unique operational, search and rescue, and environmental considerations. Ships will have a special certificate for meeting these standards, and carry aboard with them a Polar Water Operation Manual (‘PWOM’) with which to comply.

This Code is considered the culmination of the work of industry and the classification societies regarding the peculiar conditions and problems posed by Arctic and Antarctic conditions, integrating it into the other IMO regulatory codes.

At Gard, we see the Polar Code as a definite step in the right direction, addressing the unique risks in the Arctic.

Conclusion

The Arctic has offered for centuries the lure of commercial success for those ship operators intrepid enough to brave the unique conditions there. Such courage of the shipping world to go to the Arctic has been facilitated by the twin entities of marine insurance and classification societies, which have intertwined roles.

Marine insurers have assessed the risks and calculated how to cover them, allowing the ship operator to pay a sum certain in premium, thus quantifying the amount of risk they are willing to take in a term of 12 months. Classification societies have worked to formulate technical based rules for the design, construction, and operation of ships that can safely operate in the Arctic, based on a certain set of conditions.

This has then had the indirect influence on societal decisions on the permitting of Arctic operations within certain risk parameters. This does not mean, however, that things cannot go wrong. From time to time things have indeed gone wrong, but to date without major loss of life or environmental harm. Will that luck hold over time?

There is always a residual risk, no matter how well operated or planned a voyage to the Arctic might be, and as this activity increases, the odds of an incident of magnitude there increases. Indeed, the trend of increased activity occurring in the Arctic is clear: oil & gas exploration, navigation on shorter trade routes, and tourism to the Arctic, have all increased significantly in the last few years.

At Gard, we see the potential for ongoing Arctic activity impacts to increase, not particularly due to the periodic transits of that region (NSR, NWP), but due to increasing regular effects of oil and gas exploration, such as the activity supported by the Port of Sabetta, and more activity in Norwegian zone in the Barents Sea.

As for the transits along the Northern Sea Route, the use of a convoy system and the provision of free salvage services by the escort fleet of Rosatomflot is essential to the scheme to use that route. Currently there is almost no salvage infrastructure available nearby, and the conditions confronting outside help to reach that area are rough and unpredictable.

It is for governmental policy makers and the public constituencies they represent to decide the question: how much, and what kind, of commercial marine activity in the Arctic can be allowed in the years to come? While marine insurers and classification societies can exercise some limited influence on such decisions, they mainly follow the pathway set by the enlargement of shipping activity by ship-owners, and then thereafter act, to try to ensure this new activity be done responsibly, in a sustainable way.

The above text is from a paper submitted by Frank J. Gonynor, Senior Claims Adviser, Lawyer in Gard (North America) Inc. for the 2017 North Pacific Arctic Conference, “Building Capacity for a Sustainable Arctic in a Changing Global Order”.

Related Articles

Climate change creates a new trade route - and new risks

Ice damage – navigating the charterparty terms