At our recent webinars, special guest Prashanth Athipar, the Principal for Sustainability and Maritime Supply Chain Excellence at BHP, and speakers from Gard’s Charterers & Traders and Loss Prevention teams came together to discuss how GHG emissions reduction targets are being approached by regulators and the maritime industry. In this article, we follow up on some of the questions put to them during the webinars.

Taking aim: reaching carbon emission reduction targets

Published 11 August 2021

Introduction

The International Maritime Organization (IMO) has announced several ambitions relating to the reduction of the shipping industry’s greenhouse gas emissions, including the aim to reduce GHG by at least 50% by 2050 compared to 2008 levels.

Complying with these standards will be challenging. However, some major charterers, including BHP, are aiming even higher. They are choosing to go beyond meeting the minimum regulatory standards and are emerging as key players in global initiatives to reduce GHG emissions.

The regulatory environment continues to develop. As industry stakeholders seek a greener outcome, how will this impact ship vetting, and what are the possible commercial tension points between owners and charterers? These questions and more were discussed in our webinar followed by a lively question and answer session. Many of the questions were highly technical and we suggest that those readers who are not familiar with GHG rating systems, take a look at the video of the webinar to provide context to the questions and answers below.

Wan Jing Tan, Senior Lawyer Charterers & Traders and Kunal Pathak, Loss Prevention Manager Asia, join Prashanth Athipar in responding to questions raised yet unanswered during the limited Q&A session. Because many of the questions involved rating, we sought additional input from RightShip and are grateful for their contribution to this article.

Question: CO2 emissions are forecast to jump this year by the second biggest annual rise in history, as global economies pour stimulus cash into fossil fuels in the recovery from the Covid-19 recession. Has this aspect been considered while planning the shipping forecast?

Kunal: This question is perhaps best addressed by the delegates at the IMO. We as a club cannot predict if global economies will continue pouring stimulus into the fossil fuels industry. What we can comment on is that greenhouse gas (GHG) reduction has been on the IMO’s agenda for over a decade now and the IMO’s vision with the 2018 GHG reduction strategy is to reduce GHG emissions from international shipping and, as a matter of urgency, aim to phase GHG out as soon as possible in this century. It is worth highlighting that the IMO did touch upon the topic of potential caveats of COVID-19 on emission projections in its fourth GHG study and as they rightly acknowledged the pandemic has still not ended and a complete assessment would demand further modelling using updated data.

In its current form, IMO’s GHG strategy aims to reduce CO2 emissions per transport work, i.e. carbon intensity, by at least 40% by 2030 and by 70% by 2050, and also reduce the total annual GHG emissions by at least 50% by 2050. These reduction rates are in reference to the 2008 emissions baseline. Furthermore, there are likely to be higher ambitions after the strategy review which is planned in 2023. In short, it is likely that the incremental approach to reduce CO2 intensity as well as GHG emissions will take into account how the industry progresses towards the set goals.

Question: I would like to know if GHG ratings are solely rated by RightShip? Is there a universal rule to rate this?

RightShip: In the current setup, Rightship’s GHG rating is the only known GHG vessel rating system for charterers and shipowners. However, given the global focus on reducing GHG emissions, we expect to see the adoption of national rating systems for vessels calling certain countries or ports. Some of this is already in place with some ports giving subsidies on port dues for vessels that can demonstrate reduced GHG emissions, for example, the Port of Vancouver offers up to 50% discount on port fees for the most efficient vessels. We should also mention that RightShip is currently assessing the outcome of IMO’s MEPC 76 and the option to align our approach with that of IMO’s Carbon Intensity Indicator (CII) is still on the table. We will formalize our review and path forward in the near future.

Question: How often will vessels be rated?

Kunal: As decided by IMO in MEPC 76, the CII regulations take effect from 1 January 2023. Each year the attained CII will be calculated for every vessel and a rating from ‘A’ to ‘E’ assigned to it. Vessels will receive the first rating in 2024 based on a comparison between the ‘required CII’ and ‘attained CII’ once they submit their emissions data for the calendar year 2023. The ‘required CII’ will be reduced annually from 2023 till 2026. As for the reduction rates from 2026 till 2030, IMO will review these at a later date. Notwithstanding that the reporting to the flag state will be on an annual basis, owners might need to monitor their operational carbon intensity continuously and even predict it to ensure that the vessel remains compliant.

It is worth commenting on RightShip’s bell curve like system for rating vessels, which we also addressed in our webinar. The rating system is currently based on the design and technical parameters of the vessel and not its operational performance. There are 7 rating bands, ‘A’ to ‘G’ with ‘A’ representing the most efficient vessels and ‘G’ the least efficient vessels. As newer and greener vessels enter the market, ratings of existing vessels may drop. For example, a vessel that is rated ‘B’ today might be rated ‘C’ or ‘D’ in future with the entry of newer and more fuel-efficient vessels. For further details, readers may contact RightShip.

Question: What is the panel’s take on the multiple GHG vessel emission calculation criteria and will BHP and other charterers adopt IMO’s CII as the standard for a vessel's carbon intensity, or will they use their own rating systems?

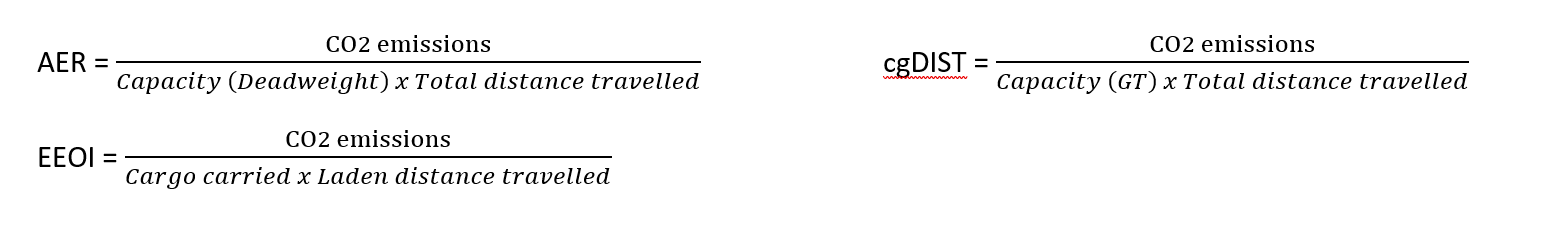

Kunal: In addition to IMO’s CII rating system, there currently are a number of other initiatives which either rate vessels, set emission targets or standards for reporting emissions, such as RightShip, Sea Cargo Charter, Poseidon Principles, Environmental Ship Index (ESI), Science Based Targets Initiative and the GLEC (Global Logistics Emissions Council) Framework to mention a few. Calculation of carbon intensity also differs amongst these different systems, for example some use Annual Efficiency Ratio (AER) whilst others may be using Energy Efficiency Operational Index (EEOI). Simplified formulas used for AER and EEOI are shown below. Reference baselines for rating the vessels may also not be the same, in terms of base year (for example it is 2019 for the IMO and 2012 for the Poseidon Principles) and also in terms of shape (for example, it’s a smooth curve for the IMO whereas it is a stepped line for the Poseidon Principles). IMO’s CII rating scheme will be based on AER or cgDIST, where ‘deadweight’ in denominator is replaced by ‘gross tonnage’ for vehicle carriers, ro-ro ships and cruise ships. A correction factor will also be applied depending on vessel type, for e.g. for fuel used in non-propulsion related ship operations such as cargo heating and the IMO has yet to finalize this.

Insight_CarbonEmissions_formula_Aug2021

Multiple rating criteria is likely to cause confusion for the vessel operators. We therefore support a more harmonized rating system incorporating not only the operational efficiency of the vessels but also their design. It is worth mentioning that all the other initiatives mentioned above were introduced prior to the IMO adopting its CII rating scheme in June 2021 and it remains to be seen to what extent the other industry initiatives will align with IMO’s scheme.

Prashanth: RightShip has for a long time been the only platform or tool available for stakeholders to assess the environmental rating for a vessel. We need to acknowledge that Energy Efficiency Design Index (EEXI) and CII are new concepts that were adopted by the IMO recently. Our understanding is that RightShip is reviewing how best to incorporate the IMO rating scheme into its own vessel rating criteria. BHP will closely monitor the GHG rating space as it is expected to evolve further and to supplement Rightship’s rating system, BHP is open to using other platforms or rating systems. As charterers we would of course also not like to have multiple rating systems in the market as it leads to complexities. That being said, any rating system should not be based solely on operational performance of the vessel, such as CII but the design and technical parameters must also be factored in for charterers and other stakeholders to know how efficient a vessel is on the whole.

Wan Jing: I agree that multiple rating criteria causes confusion for all parties in the industry. Without a harmonized rating system, it is difficult for operators to know where they stand in relation to the regulations and what steps can be taken to comply, and charterers may find it difficult to compare or assess vessels.

As explained during the webinar, operators are likely to face practical hurdles in establishing in advance if the effect of a charterer’s instructions would cause the vessel to breach obligations under international law, so as to allow, or oblige, them to reject the instructions. This is further exacerbated by the fact that there are multiple rating criteria. Without any certainty on the rating criteria, parties will find it challenging to plan ahead and cater for such regulations in long-term charterparties. It is in the industry’s benefit to have a single/harmonized rating criteria to give parties certainty as to how the vessel’s performance and compliance can be measured and allow both operators and charterers to be able to take steps to plan for the same.

Question: How will the dual fuel option play out for charterers under the charter party?

Prashanth: This topic of alternative fuels and key considerations for different stakeholders was talked about in detail during the webinar. As charterers, BHP is more than happy to sign long term charters for dual fueled vessels. As everyone will acknowledge, the real dilemma here is that no one can predict if the fuel of the future will be LNG or ammonia or something else entirely. For us, it is important to know that the engines of the dual fueled vessels are future proof, for example, are they able to use ammonia too or only LNG? That being said, some of the key considerations for BHP when looking to charter in dual fueled vessels in today’s market would be

Whether it is a time charter or voyage charter, and the trading route.

Charterparty clauses such as for vessel’s performance (speed and consumption), off hire etc., and how these fit into BHP’s commercial mandate.

The bunkering infrastructure and the potential deviation there including the time taken for bunkering. If it results in the ships performing lesser voyages in a given period of time than what they usually did, then it could lead to commercial losses in the form of deviation costs and production losses.

The specifications of LNG fuel.

Crew competency would be a core issue. The engines and fuel will be different for most of the crew and their lack of training would present a risk for us.

Wan Jing: The considerations for charterers will differ depending on the charterparty and the trade within which they are operating. A voyage charterer may also need to consider the potential trading limitations of a dual fuel vessel – after all, the routes could largely be dictated by the available infrastructure for bunkering. A dual-fuel vessel could work quite well for consecutive voyage charters (CVCs) where there is a fixed route for the vessel and certainty as to where the vessel is repositioned and where the vessel can stem the requisite bunkers along those fixed routes.

From a time charterer’s perspective, in addition to the limited infrastructure for bunkering, there are other issues to consider. This is by no means exhaustive, but parties should consider these in detail:

The mechanism in the charterparty on when to switch fuel and the effect on the speed of the vessel, and the corresponding warranties. The calorific value of the alternative fuel, which may vary over time and supply source, is different and therefore would affect the speed and consumption rates of the vessel. Preparing suitably detailed fuel consumption warranties may take significant effort. They will need to balance a technically realistic statement of the vessel’s abilities, with a warranty that is sufficiently certain to enable the charterer to assess the value of the vessel and be able to market her once chartered.

The different fuel options may also affect the calculation of off-hire. Which fuel should be burned during off-hire? Is it in charterers’ option, or owners’? If cheaper fuel is used during off-hire which causes an increase in the fuel cost for the rest of the voyage, who is responsible for the extra cost?

The price of the different fuels will change over time, and not always with a positive correlation. So it is also important to consider charterers’ duty to supply which type of fuel during the course of the charterparty, and the type of fuel on board on delivery and redelivery and how to calculate any shortfall upon redelivery. Depending on the available infrastructure, it may be necessary to stipulate that the vessel must be delivered or redelivered with a quantity of fuel on board that is within an agreed range.

Who as between owners/charterers bears the risk of regulations changing so as to prohibit the use (and possibly even carriage) of alternative fuels? Do owners warrant that both will always be capable of being consumed as/when charterers instruct?

The different fuels may have different impacts on carbon taxes if/when they are introduced. Do the tax clauses cover what is needed?

Fuel cost issues, including those related to taxes, can also arise under CVCs or COAs where the freight contains a bunker adjustment factor. The charterer would often want fuel costs to be adjusted by a mechanism where price risk can be hedged – but that may be more difficult if the fuel in question is not (yet) commonly used as bunker fuel.

Question: My understanding is that amount of cargo carried affects the vessel’s CII rating. Would owners be in breach if they minimize cargo intake for a particular voyage?

Kunal: Once CII regulations are in force, the vessel operators will have to manage a balance between environmental compliance, contractual obligations and the commercial viability of the vessel. The CII rating will use the vessel capacity (GT or DWT) in the denominator instead of cargo carried, as highlighted above, and theoretically speaking vessels might be able to improve their CII rating or prevent it from dropping if volume of cargo carried is restricted as the vessel will then be sailing at a shallower draft and consume comparatively less fuel. Practically how much of a benefit would it bring is unclear, but it will certainly significantly impact the commercial viability of the vessel. Our understanding is that reducing the cargo intake alone may not help the vessel achieve the desired rating. Furthermore, given that the CII rating will have an annual reduction factor starting 2023 to 2026, it is going to take much more for an owner to maintain a minimum of a ‘C’ rating by just reducing the cargo intake of the vessel. It is worth mentioning that if EEOI is used as the metric where cargo carried as a parameter in emission calculations, vessels are rewarded for maximizing capacity utilization.

Wan Jing: Operationally, it is open to owners to either reduce speed or cargo intake, in order to reduce the actual emissions for a voyage. It could also be a combination of both, depending on the owners’ calculation. If owners choose to reduce the cargo intake, then there is a possibility of being in breach of the duty to ensure that the whole reach of the vessel is made available under a time charter or perhaps the quantity of cargo to be carried under a voyage charter. Owners could perhaps argue that they are not obliged to comply with these instructions to load to maximum capacity because of the overarching need to comply with the regulations. This would be similar to owners’ defence for the vessel sailing at reduced speed should that constitute a breach on owners’ part.

As explained above, owners may face some practical difficulty as it is likely to be difficult to predict the aggregated emissions and monitor how the vessel’s trading pattern and the cargo it carries affects the aggregated emissions. Aggregated emissions are calculated at the end of the year and it compares the total emissions from the vessel over the year against the cargo carried and distance travelled. It will be challenging to pinpoint exactly which voyage or instruction had caused the emissions to increase and it will be even harder to argue that this specific instruction/voyage will cause the aggregated emissions, to be calculated in the future, to spike.

Further, a drop in the CII rating does not necessarily mean that owners are not compliant with the regulations, even where corrective measures may need to be taken by owners. There could therefore be a degree of difficulty in establishing cause and effect, i.e. that the voyage instructions will cause owners to breach their obligations under international law and therefore owner are entitled to not comply with the same.

We would recommend that, if possible, parties should make it clear at the time of contracting what the vessel’s limitations will be, whether that is speed or intake, and over what periods of time.

Question: Filtering out poor GHG vessels is a good step but what plans does a large trader like BHP have to facilitate development of cross trades to reduce the need for full-blown ballast legs thereby instantly reducing the ton-mile CO2 emissions?

Prashanth: It is still early days for BHP and I am sure it is the same for many other organizations too. This goes to the root of vessel sourcing strategy. It is currently commercially driven - there has to be a demand for our products for us to charter in tonnage. For vessels on voyage charter it is up to the owners to fix the vessel to go to a nearby port to load the next cargo with another charterer, rather than doing a long ballast leg.

Question: How would an underperformance claim be presented if the vessel’s engine is derated or power limited?

Wan Jing: Engine derating is a permanent modification to the engine to permanently reduce the engine power output in order for the vessel to comply with the EEXI requirement. Power limitation, however, usually refers to an over-rideable limit for throttle range and is therefore a temporary measure. Regardless of whether an engine is derated or power limited, these only affect the maximum speed at which a vessel can sail. In order to be compliant with the regulations, the vessel’s operations will still need to meet the CII requirement, and that could translate to, for example sailing at reduced speed.

The answer here will depend on the clauses agreed.

Sailing at a reduced speed does not necessarily mean that there is an underperformance claim - the vessel could still be meeting the minimum warranted speed. If, however, the vessel needs to sail at a speed which falls below that of the minimum warranted speed in order to meet the CII ratings, then there may be an underperformance claim. It is entirely possible for charterers to simply say the vessel is warranted to sail at, perhaps, minimum 13 knots under the charterparty and as the vessel is not doing so it is a breach of the warranty provided in the charterparty.

Owners may argue that they are sailing at reduced RPM and that there is no applicable warranty for speeds at the reduced RPM, so charterers need to measure the performance of the vessel against that reduced RPM. If there is an argument that no warranty applies, then an underperformance claim could require a technical or expert assessment for each voyage.

Assuming the speed reduction is necessary to comply with regulations, as a result of previous orders given by charterers, the owners may argue that to the extent there is an under-performance, it is the direct result of the previous voyages undertaken, so that no claim is possible. It may be seen from this that the issues might be very different under a long term, and short-term charter. Under a long-term charter, the charterer might need the owners to provide reliable information on performance restrictions, so that it can be included in the warranties under sub-charterparties. Performance warranties in long term charters may also need to provide for an adjustment of the vessel’s operating speed resulting from previous charterers’ orders. It is likely that performance warranties, and in fact even the structure of charterparties, will have to be updated significantly in the future.

Question: Has BHP looked into introducing a ’Just in time’ clauses (a clause entitling a charter to order reduced sailing speed where the discharge port is congested), and if not is this because it is currently not possible to join the line up at the discharge port until you are an arrived ship?

Prashanth: Ships spending more time at anchorage whilst waiting for a berth is certainly not good for the environment. It also increases operational risk for the vessel and certainly has cost implications for stakeholders. Over the past few years, BHP has been able to reduce the average staying time at anchorage for its chartered vessels by a few days. When it comes to JIT clauses, the inconvenient truth or rather the challenge for charterers such as BHP is that they do not operate the port and therefore do not have much influence on the line-up of the vessels. BHP has already engaged with ports/terminals to better streamline the process and is more than happy to have similar discussions with its clients and, the shipowners.

Question: To comply with EEXI, an owner may choose Engine Power Limitation (EPL) as a solution. However, RightShip does not accept such a deep reducing engine power for GHG Evaluation. In such a case how can an owner clear both EEXI and GHG Rating, i.e. better than F rating?

RightShip: RightShip has an acceptance criteria for EPLs which can be found here. The acceptance criteria remain in place, and the reason we limit the EPL is to drive innovation in the market, rather than shipowners and operators relying solely on EPLs, which is basically the premise of EEXI. RightShip’s aim is to work with the market to unlock innovative measures to drive down CO2, rather than EPL being seen as the ‘only mechanism’. Since we introduced the EPL criteria we have seen a huge shift towards other types of energy saving equipment, as opposed to EPLs, such as wind power, Mewis Duct, PBCF, etc. This is evidence of our process and structure working to shift the market towards more innovative outcomes.

Question: To comply with your mandate regarding greenhouse gas emissions do you foresee BHP's operating costs increasing?

Prashanth: BHP does not believe that the drive for decarbonization will result in an increase in the operating costs for them. Taking the example of an LNG fueled vessel, there is no doubt an increase in CAPEX (capital expenditure) but it is balanced by a reduction in OPEX (operating costs) and if it is a high pressure engine then along with the consumption, GHG emissions is much lower. Also, without going into the details, there are mechanisms built into the commercial market to absorb the higher costs. It is worth mentioning that looking at operating costs in isolation is not the correct approach. A company should also consider reputational implications, view of shareholders, regulatory developments, market-based measures available and so on.

Question: I am curious to know if the BHP scope 3 emission goal is mainly based on technical advances or a combination of carbon-offset and technical progress in the design and operation of new tonnages.

Prashanth: Scope 3 emissions occur outside of our operated assets and are emissions over which we do not have operational control, although we can influence some aspects of it. The bulk of our scope 3 emissions come from the processing and use of our products, in particular steel making, and emissions by ships transporting our products forms a very small percentage. Use of carbon offsets is certainly an option for charterers such as BHP, but BHP’s view is that it is one of the last options to consider. BHP is committed to reducing the actual emissions across the whole supply chain and when it comes to chartered in tonnage, BHP looks at both the design and machinery of the vessel along with voyage optimization. The intention is therefore to look at a combination of solutions to achieve our climate goals. It is worth mentioning that BHP is also taking steps to test alternative fuels, such as bio-fuels and LNG in cooperation with the ship owners and has also actively participated in setting up a maritime decarbonization centre in Singapore along with MPA and other organizations to further explore the solutions to achieve carbon reduction.

Question: Does BHP agree to increase the price paid to shipowner to compensate for the cost of upgrades?

Prashanth: As we had said in our key takeaways during the webinar, no business model will be sustainable unless it is socially responsible and commercially viable. Shipowners who are not considering investing in newer technologies and fuels to reduce carbon and other greenhouse gasses, would definitely lose out on business in the coming years. BHP’s thinking is that sustainability and commercial operations have to go hand in hand. As of today, perhaps greener vessels are being treated as a premium product but in a few years’ time that will not be the case.

A few concluding remarks

GHG reductions could be the biggest challenge facing the maritime industry in several decades. During our webinars we touched upon just some of the technical, legal and commercial issues facing owners and charterers, but we are only at the beginning of this journey.

Compliance with GHG reduction requirements is demanding both from the perspective of technical resources and in terms of the capital outlay which could be required. In the immediate future, owners will need to focus on ensuring that their existing fleets comply with IMO and charterers’ environmental vetting requirements. Compliance with EEXI requirements could require operational changes and/or retrofitting of equipment. Whilst MEPC 76 in mid-June has clarified certain aspects of the CII rating system, there are questions surrounding practical application and monitoring of the CII once the regulation comes into force. Owners and charterers are already looking at new fuels and technologies when trying to decide what strategies are likely to pay off in the longer run. These are not easy decisions and significant capital investment will be required to build the new greener ships that use these fuels and technologies. The technical and financial demands of compliance are such that they could very well put smaller operators under significant pressure leading some to speculate that consolidation may become more prevalent.

There are questions surrounding the suitability of the existing charterparty forms. At the very least, amendments and specific clauses will be needed to address some of the commercial issues surrounding GHG compliance. However, there are some in the industry that are questioning whether existing charterparty forms, which incentivise owners to “sail quick and arrive early” are fit for purpose in an environment where the reduction of GHG emissions is a key priority.

Finally, the regulatory environment is not standing still. Regional carbon tax schemes continue to emerge where the vessels will be subject to additional tax based on their emissions profile. The additional costs associated with these are significant and are provoking strong reactions from shipowners’ industry groups. There is also likely to be some discussion between owners and charterers moving forward as to how these costs will be managed commercially.

Gard is working hard to stay abreast of developments and we will continue in our efforts to keep our Members and Clients informed.

Thanks to Prashanth Athipar of BHP for his participation in the webinars and for his contributions to this Insight.

We would also like to thank Edwin Pang who is the Chairman of the RINA (Royal Institution of Naval Architects) IMO Committee and Kris Fumberger of RightShip for their valuable inputs to this Insight.

There were many others from across Gard that contributed behind the scenes, but a special thanks to Siddharth Mahajan, Loss Prevention Executive, Asia for his significant contributions to the content of the webinars and this Insight.