At the recent meeting of MEPC 83, the IMO member states reached agreement on the first global GHG emissions levy for any industry. This comprises a global fuel standard, financial penalties and incentives, and a fund to support decarbonization initiatives with the aim of achieving the IMO’s 2023 GHG strategy of net zero by or around 2050.

The IMO interim emission measures: an overview

Published 23 May 2025

On 11 April 2025 the IMO announced that agreement had been reached by the member states at MEPC 83 on interim measures as part of the IMO’s 2023 greenhouse gas (GHG) strategy to achieve net-zero by or around 2050.

The proposed new chapter 5 to MARPOL Annex VI provides that the GHG intensity of all energy used by vessels - referred to as the GHG Fuel Intensity (GFI) - is to be progressively reduced.

The measures will start from 1 January 2028 and apply to vessels of 5,000 gt or above.. There are two reduction trajectories: the more modest ‘Base’ target and the more ambitious ‘Direct Compliance’ target. These measures are intended to align with the IMO’s ‘base’ and ‘striving for’ GHG reduction targets

If the vessel meets the more ambitious Direct Compliance target, the shipowner will receive surplus units (SUs). These can either be banked or transferred to other shipowners. By contrast, if the vessel fails to meet the required targets, the shipowner will have to purchase remedial units (RUs) at differing cost-levels, depending upon the degree of non-compliance.

The revenues from the RUs will be transferred to the IMO Net-Zero Fund, which will be managed by the IMO. This is intended, in part, to incentivise the use of zero and near-zero (ZNZ) fuels. The financial level of reward will be determined by 1 March 2027.

The MEPC will reconvene in October to adopt the proposal. This requires a two-thirds majority of the 108 Member State parties to MARPOL Annex VI, a total of 73 states. The majority voting in April saw 63 in favour, 16 opposed, and 24 abstentions; so, work will have to be done before October to secure the necessary additional support.

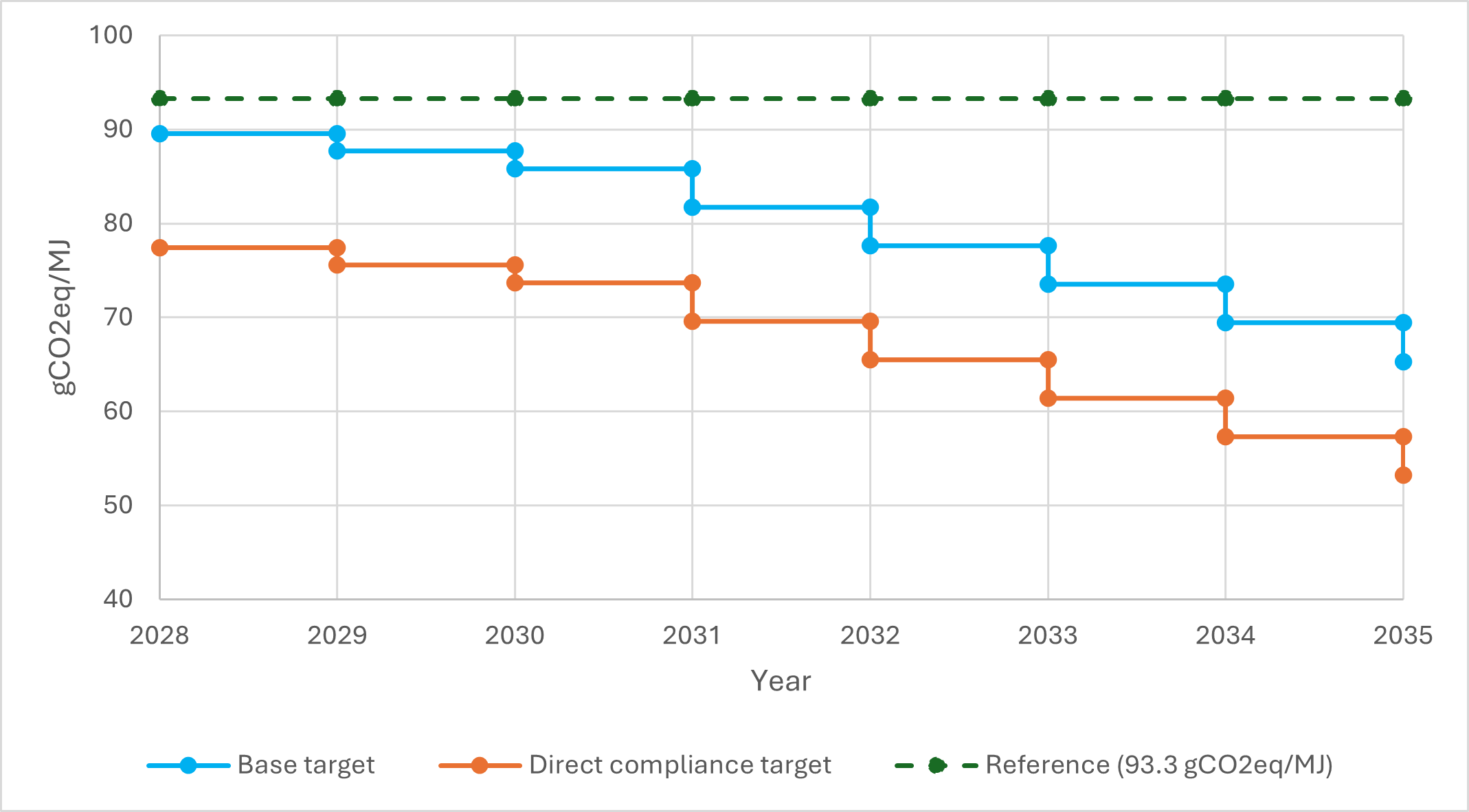

Fig.1 Trajectory for Base and Direct Compliance targets (2028-2035)

The basics of the GFI

The GHG Fuel Intensity (GFI) mid-term measures agreed are similar to but broader than the FuelEU Maritime Regulation. We will explore the similarities and differences in a subsequent article.

The GFI is the GHG intensity of the energy used onboard a ship. This comprises the energy from the fuel, from other sources, e.g. wind-assisted propulsion, and savings in emissions from technology such as carbon capture. The GFI is a measure of the grams of CO2 or CO2 equivalent, i.e. methane, nitrous oxide, per megajoule of energy; the unit is gCO2e/MJ. This is the same as the measure used for FuelEU Maritime.

Each energy source, whether it be fuel or alternative energy, is given a well-to-wake (WtW) figure for the GHG emissions. These are the GHG emissions throughout the lifecycle of the energy source: production - transportation – consumption onboard. The GFI figure for each fuel or energy source will be calculated by an IMO-recognised Sustainable Fuel Certification Scheme.

Starting from 1 January 2028 there are two trajectories of reductions in the permitted GFI levels as compared to a 2008 starting figure. See Fig.1 above:

The ‘Base’ target which tracks the IMO’s base targets of a 20% reduction in GHG emissions by 2030 and 70% reduction by 2040; and

The ‘Direct Compliance’ target. This tracks the ‘striving for’ targets of 30% and 80% reductions, respectively.

The two target trajectories have been agreed up to 2035 only, other than a single Base target reduction of 65% for 2040. The targets for the period 2036 to 2040 must be agreed by 1 January 2032.

By March each year, the shipowner will report the weighted average GHG intensity of the energy used onboard the vessel over the previous calendar year. This is the vessel’s Attained GFI. The shipowner will also report the vessel’s annual GFI Compliance Balance. This is the difference between the Direct Compliance target and the vessel’s Attained GFI, multiplied by the total energy used that year. It will be a positive or negative figure, measured in tonnes of CO2eq.

The reporting obligation applies to all vessels of 5,000gt or above, subject to several exceptions: ships operating only in the waters of their flag state; ships not using mechanical propulsion; FPSOs, FSUs, drilling rigs and semi-submersible vessels.

The consequences of compliance and non-compliance

The financial consequences of compliance or non-compliance can be illustrated by the example of a vessel operating on LNG in the period 2028-2035, with an Attained GFI/ GHG intensity figure of 76.1gCO2eq/MJ.

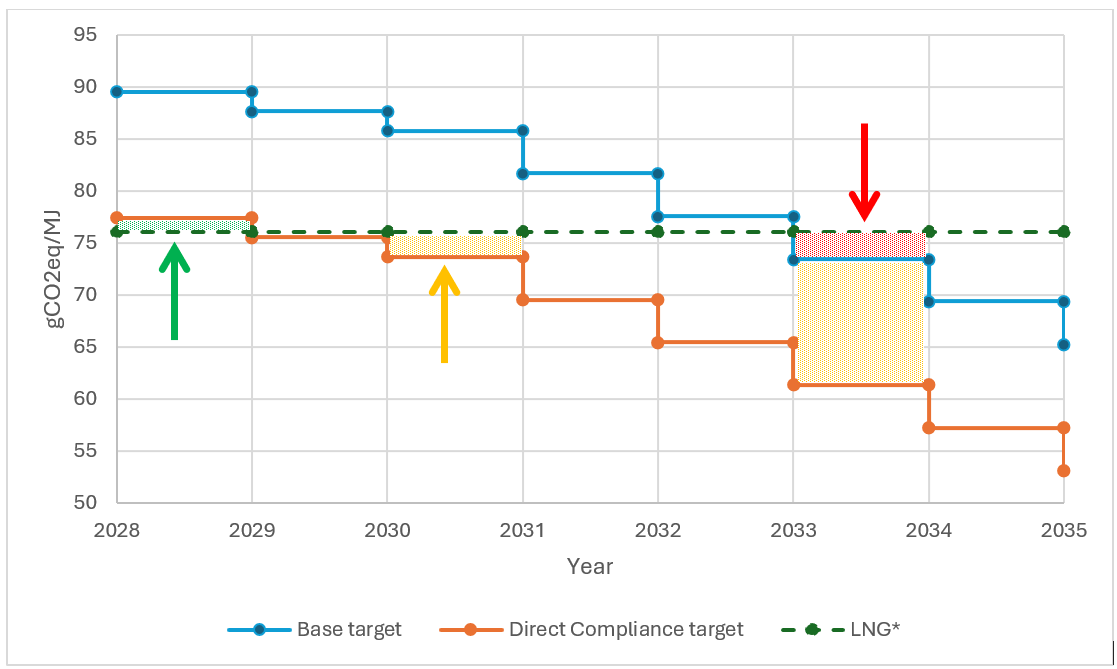

Fig.2 Illustration of Compliance Surplus, Tier 1 and Tier 2 Compliance Deficits based on LNG

In the first year, 2028, the vessel’s Attained GFI is below the Direct Compliance target (green arrow area in Fig.2 above).

As a result, the ship will have a compliance surplus and receive Surplus Units (SUs). Each SU equates to 1mtCO2eq.

These SUs can be banked, to be used for future years’ compliance as the target GFI level reduces (NB. SUs expire after two years). Alternatively, the SUs can be transferred to non-compliant ships. This is a one-time decision, meaning a banked SU cannot subsequently be transferred.

In 2030, the vessel’s Attained GFI achieves the Base target but not the Direct Compliance target (orange arrow area in Fig.2 above).

This means a negative compliance balance, termed a Tier 1 Compliance Deficit. The ship will have to purchase Remedial Units (RUs) from the IMO, with each RU equating to 1mtCO2eq. The initial cost of an RU is US$100/mtCO2eq.

In 2033, the vessel’s Attained GFI does not meet the Base target (red arrow area in Fig.2 above).

The negative compliance balance is termed a Tier 2 Compliance Deficit. The ship will have to either purchase RUs from the IMO, or purchase SUs from a compliant ship. The initial cost of RUs for a Tier 2 Compliance Deficit is significantly higher, at US$380/mtCO2eq. The transfer of SUs is capped at the equivalent price (i.e. US$380/SU).

The ship will also have to purchase RUs from the IMO (only) for the Tier 1 Compliance Deficit (orange shaded area) at the lower Tier 1 price.

The first RUs will be purchased in 2029, for any negative balances in 2028. The cost of the RUs will increase from 2031 to incentivize shipowners to switch to compliant fuels or adopt alternative compliant energy sources (such as onboard carbon capture).

IMO Net-Zero Fund

The money the IMO receives for the RUs will be used to create the IMO Net-Zero Fund. This is anticipated to be used for two principal purposes. One is to incentivize the use of ZNZ fuels. To qualify as a ZNZ, the fuel must have a GHG intensity of 19gCO2eq/MJ or less (up to the end of 2034) and 14gCO2eq/MJ or less from 2035. E-methanol and e-ammonia are likely to achieve these figures, assuming fully renewable electricity is used to produce them. The financial rewards for the use of ZNZ fuels will be decided by 1 March 2027.

The other purpose is to promote a just and equitable transition in maritime decarbonization efforts, particularly of small island developing States (SIDS) and least developed countries (LDCs). This is expected to include R&D and production of ZNZ fuels and other energy sources, associated infrastructure, training, technology transfer, capacity building, and fleet renewal and upgrade.

Industry response

The mid-term measures agreed have been broadly welcomed by the shipping industry, although there have been concerns expressed that the proposal adopted introduces a two-tier track to decarbonization. It has been suggested by some commentators that this could result in slower overall reductions in GHG emissions as shipowners chose to achieve compliance with the Base target and then pay the lower USD 100/mt RUs rather than invest in equipment/fuels to achieve the Direct Compliance target.

Another issue identified is that the measures do not necessarily generate predictable or stable revenues, nor certainty for financing an equitable transition. The IMO Net-Zero Fund is likely to receive approximately USD 10-12bn a year initially, which many believe is less than what is needed to achieve an effective and just transition.

The International Chamber of Shipping has stated that “although not perfect in every respect, we very much hope [it] will be formally adopted later this year”, going on to say that “We recognise that this may not be the agreement which all sections of the industry would have preferred, and we are concerned that this may not yet go far enough in providing the necessary certainty. But it is a framework which we can build upon”.

The Union of Greek Shipowners has expressed serious concerns about the feasibility of the targets set, referring to the lack of unanimity and reservations of several countries. It has welcomed the adoption of the polluter pays principle and the transfer of the compliance costs to the commercial operator of the vessel, but stated that the role of transitional fuels, such as LNG, has been unfairly treated which will undermine existing decarbonization investments by shipowners.

Whilst there are some negative sentiments, it should not be overlooked what a historic achievement this is. So long as they are formally adopted in October 2025, the IMO’s mid-term measures will be the first global GHG emissions levy agreed by any industry. They ought to provide a clearer pathway to decarbonization and encourage the maritime industry to invest in the necessary vessels, equipment, infrastructure and energy sources.